WHISTLER MARKET REPORT

YEAR END 2023

2023 was an overall slower year in the Whistler and Pemberton real estate markets, allowing inventory to tick up while prices held. The main drivers of the lower sales volume were the impacts of inflation on households and the overall borrowing power of buyers as a result of the sustained high interest rates throughout the year.

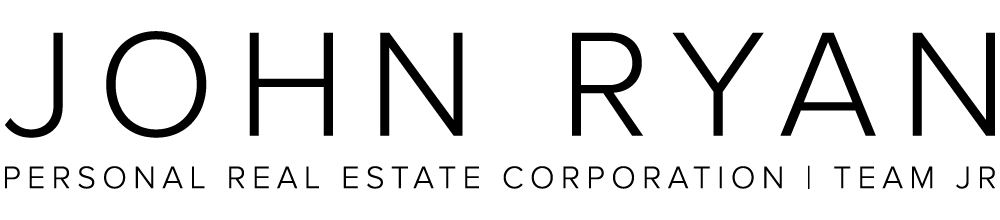

WHISTLER

In Whistler, there were a total of 490* sales in 2023, which is a 13% drop from 2022 and the lowest annual sales volume our market has seen in the last 10 years. Total sales dollar volume in the Whistler market was $867M, about $60 million shy of the 10-year average. Prices, however, remained strong, with the median sale price of a Whistler property surpassing both the 2020 and 2021 medians from the heat of the pandemic market. The median number of days for a property to sell in 2023 was 32, up from 21 in 2022, but remains below the 10-year average of 39 days. Despite a slower overall year for the market in 2023, the luxury segment remained strong with 39 sales over $4M in 2023, including a record-breaking $32 million sale. With Whistler’s exclusion from Canada’s foreign buyer ban, international buyers continued to purchase properties in 2023, accounting for approximately 13% of property purchases and 20% of dollar volume. The largest contingent of international buyers came from the United States, with US buyers representing 8% of all property purchases in the Whistler market last year.

In regard to inventory, there were 838* units brought to market this year, which is 50 fewer than last year, and the lowest number of units to hit the market in the last decade. Despite this, inventory levels were higher month-to-month versus last year (which witnessed a slow climb up from record-low inventory levels in December 2021) due to the slower sales volume, offering potential buyers more choices than they had over the course of the last couple of years.

PEMBERTON

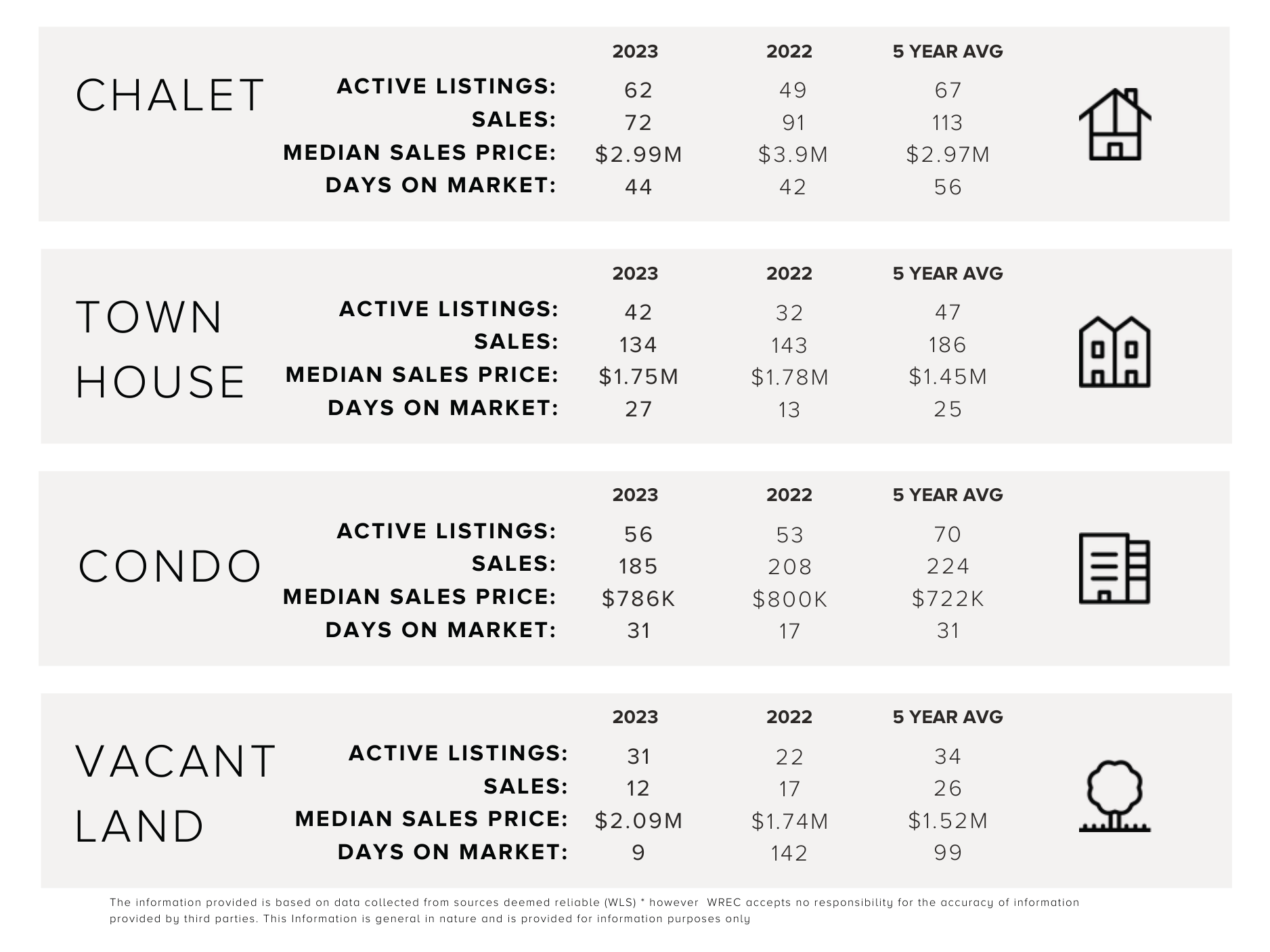

In Pemberton, there were 98* sales in 2023, up slightly from 93* in 2022, but 32% below the 5-year average. Continued high borrowing costs are responsible for the sustained below-average sales numbers. Prices remained strong with a median transaction price of $852,000, the highest Pemberton has seen. This stemmed from a notable increase in luxury sales in Pemberton in 2023 with 7 sales over $2M versus only 3 in 2022. Median days to sell for a property in Pemberton was 33, up from 23 in 2022 but still well below the 5-year average of 37 days.

In regard to inventory, there were 199* new listings brought to market, 34 of which were parcels of vacant land. The average number of units available this year was 66*, up 14% from the 5-year inventory average.

REGULATORY NOTES

As previously noted, the Foreign Buyer Ban does not apply to the Whistler or Pemberton markets, nor does the Foreign Buyer Tax. However, as it currently stands, the Whistler and Pemberton are not exempt from the Underused Housing Tax and we suggest that you talk to your accountant to see what this means for your particular property and situation.

2024 PREDICTIONS

Looking to 2024, we expect to see increased sales volumes in both the Whistler and Pemberton markets. As inflation approaches the target range and the past two years of quantitative tightening measures work their way through the Canadian economy in the form of mortgage renewals, it has been predicted that the Bank of Canada will begin dropping interest rates in 2024. There has already been some downward trending in longer-term mortgage rates. This would increase the buying power of consumers and fuel the housing market, with the Canadian Real Estate Association Predicting a 9% increase in home sales and a 1.5% increase in home prices this year. We expect increased competition in the Whistler and Pemberton markets, which both have limited supply and strong demand.

That’s it for our year-end recap. For more information about the market or if you are looking to buy or sell, contact your local Whistler Real Estate Company agent. The Whistler Real Estate Company has been the leading brokerage in Whistler since 1978 and we thank our clients for making us number one again in 2023. Cheers to 2024!

*excluding parking stalls

The information provided is based on data collected from sources deemed reliable (Whistler Listing System); however, WREC accepts no responsibility for the accuracy of information provided by third parties. This information is general in nature and is provided for information purposes only.

YEAR END 2022

The start of Q1 resembled the fast pace of 2021, but sales slowed significantly throughout the remainder of the year. This came as a function of economic uncertainty, with both a poor performing stock market and rapid interest rate increases, and also an overall misalignment of buyer and seller expectations.

WHISTLER

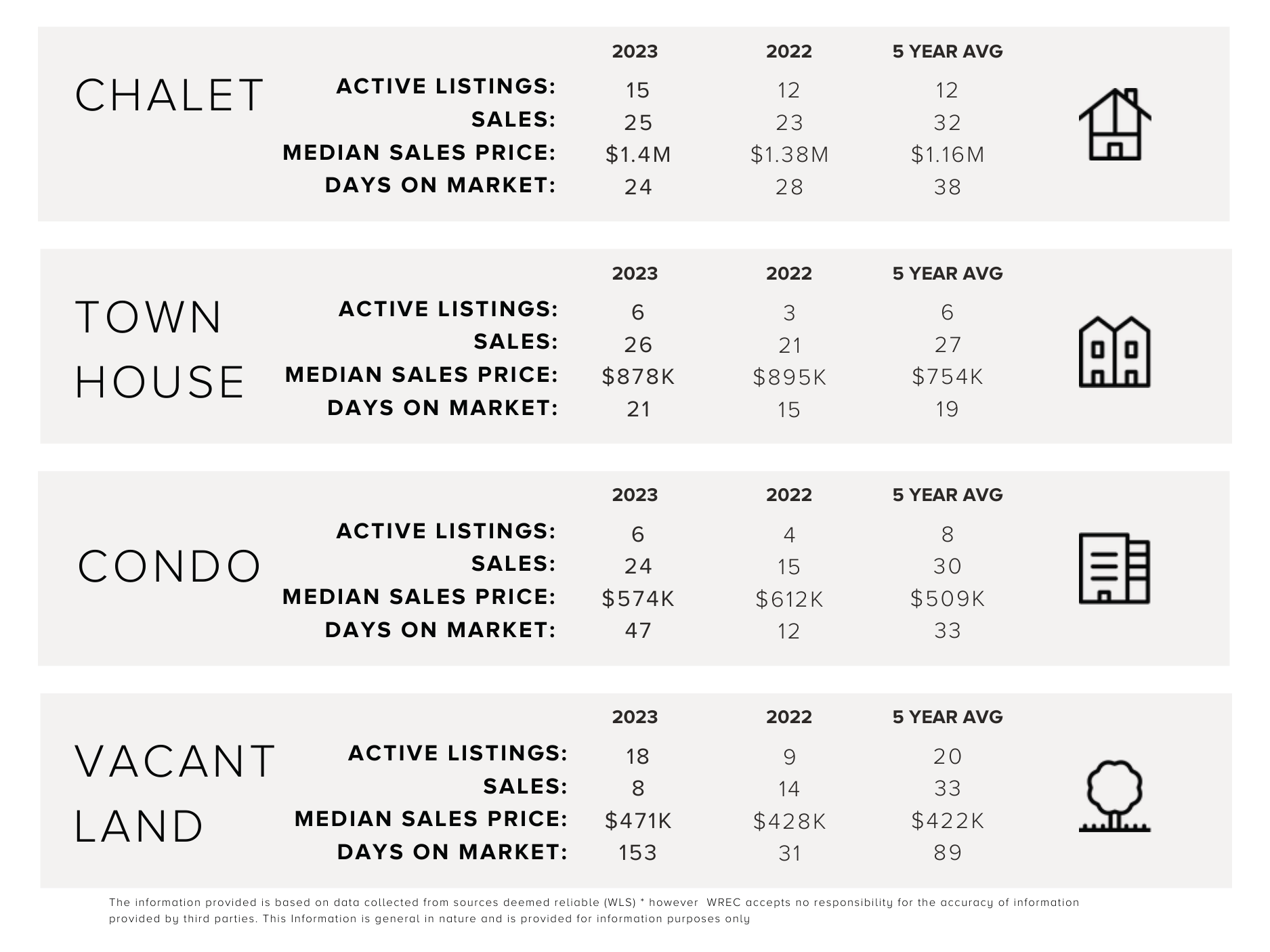

In Whistler, there were a total of 564 sales in 2022 (exc. parking stalls), which is the second lowest annual unit sales volume we have seen in the past 10 years, yet the second highest sales dollar volume with just over $1B in total market sales volume. Despite lower or falling property prices in certain regions of the country, prices in Whistler remained strong.

The median sales price of a Whistler property in 2022 was $1,200,000, up from 1,050,000 in 2021 and a significant increase from $823,600 in 2019. In regards to inventory, Whistler started the year off at historic lows, and inventory has increased slightly throughout the year, but still sits about 40% below the 10-year average.

International buyers accounted for just shy of 12% of property purchases and approximately 18% of the market in terms of dollar volume. While the percentage of international buyers doubled from 2021, fuel by the opening of Canada’s boarders back in the spring, this is still lower than historic levels as international buyers typically represent about 20% of the market.

As a reminder, both Whistler and Pemberton are excluded from Canada’s foreign buyer ban and are still open to international investment despite the ban, which we believe may drive some market activity for non-Canadians who are looking to purchase property in the Sea to Sky corridor. Looking to 2023, we expect sales to pick up and price to remain steady as Whistler market is bolstered by limited supply and high demand. Click here to view the complete stat pack for Whistler.

While the buyers of Whistler properties have historically been Canadians (primarily from the Lower Mainland), there is also typically a strong foreign buyer component (comprising of roughly 20-25%). In 2021 however, the market differed in terms of where the buyers came from, with a shift away from foreign investment, with 95% of the buyers coming from Canada.

As with all other markets in North America, demand exceeded supply in all segments of the market. The result of which was an increase in prices across all categories as compared to 2020. By the end of 2021, the supply in the Whistler market had reached an all-time low.

The strength in the market came from all sectors of the housing mix. The single-family and townhouse markets continued to see strong sales over 2020, due to pandemic demands for non-communal ownership. The luxury component of the Whistler market, already strong, showed no signs of weakening with a record-breaking 68 sales over $4,000,000 and with a top reported sale of $17,000,000.

The market for vacant land in Whistler was also very strong compared to previous years, primarily due to two project sales in the valley. The first is Wedgewood, which has been selling new phases north of Whistler, and the second is RiverRun, a project in Cheakamus that was launched in Autumn, and at the end of December, only had two lots remaining.

The condo market had weakened in 2020, but recovered in 2021 as the Hotels (Phase 2 – Condo Hotels) saw strong occupancy through the summer and into the winter. As the tourism market returned to Whistler, the sales of these types of condominiums returned to more normal levels.

As of the end of December, the average transaction value for the Whistler marketplace was $1,522,000 in 2021.

Currently the average transaction value of a single-family home is $4,139,555 (median of $3,300,000); townhouses are averaging $1,586,389 (median of $1,303,000;) and condominiums are averaging a sales value of $852,699 (median of $770,000).

LUXURY

The Luxury Market remained strong throughout 2022. There were 55 sales over $4M over the course of the year, with a top sale price of $17,250,000. The total number of luxury sales was down slightly from 2021, which was a record setting year with 68 sales.

Despite other market segments slowing down throughout the year, sales in the luxury segment remained quite active and showed little to no signs of a slow down.

PEMBERTON

In Pemberton, there were 93 sales in 2022. This was the slowest year for sales since 2013, which was likely the result of both a lack of move-in ready inventory and also the rapid interest rate increases decreasing the purchasing power of buyers. The median sales price of a Pemberton property was $829,000, up from $757,000 in 2021 and $508,000 in 2020.

In terms of inventory, the number of units available this year was about 50% below the 10-year inventory average. As we look to 2022, there is some new and exciting development on the horizon for Pemberton, both this year and into the future. We recommend contacting your local Pemberton real estate agent to learn more. Click here to view the complete stat pack for Pemberton.

We are dedicated to keeping abreast of our market to ensure we provide you with a well-informed, and current strategic view of investment potential and advice on your purchase or sale. If you have questions, or would just like to chat about the current market, please email us or call 604-932-7670 any time.

YEAR END 2021

Sales activity in 2021 started out very strong, with the first quarter of the year seeing 110 unit sales per month, with the rest of the year continuing at a strong and steady pace, of about 70 units per month.

The market broke records in terms of sales volume, exceeding $1.5 Billion in sales – an increase of 35% over 2020, which was a record-breaking year in itself.

The increase in demand for properties in Whistler was due to a result of historically low-interest rates and a desire to move to and/or invest in smaller areas, which have been seen as a safe haven during the pandemic.

While the buyers of Whistler properties have historically been Canadians (primarily from the Lower Mainland), there is also typically a strong foreign buyer component (comprising of roughly 20-25%). In 2021 however, the market differed in terms of where the buyers came from, with a shift away from foreign investment, with 95% of the buyers coming from Canada.

As with all other markets in North America, demand exceeded supply in all segments of the market. The result of which was an increase in prices across all categories as compared to 2020. By the end of 2021, the supply in the Whistler market had reached an all-time low.

The strength in the market came from all sectors of the housing mix. The single-family and townhouse markets continued to see strong sales over 2020, due to pandemic demands for non-communal ownership. The luxury component of the Whistler market, already strong, showed no signs of weakening with a record-breaking 68 sales over $4,000,000 and with a top reported sale of $17,000,000.

The market for vacant land in Whistler was also very strong compared to previous years, primarily due to two project sales in the valley. The first is Wedgewood, which has been selling new phases north of Whistler, and the second is RiverRun, a project in Cheakamus that was launched in Autumn, and at the end of December, only had two lots remaining.

The condo market had weakened in 2020, but recovered in 2021 as the Hotels (Phase 2 – Condo Hotels) saw strong occupancy through the summer and into the winter. As the tourism market returned to Whistler, the sales of these types of condominiums returned to more normal levels.

As of the end of December, the average transaction value for the Whistler marketplace was $1,522,000 in 2021.

Currently the average transaction value of a single-family home is $4,139,555 (median of $3,300,000); townhouses are averaging $1,586,389 (median of $1,303,000;) and condominiums are averaging a sales value of $852,699 (median of $770,000).

YEAR END 2020

Sales activity started slowly and then dropped to almost nothing in the second quarter, recovered and roared ahead to historical levels in the third and fourth quarters while slowing again in December.

Overall, for the year the total value of reported sales exceeded one billion dollars, and the total number of sales transactions increased by over 30 percent as compared to 2019.

The increase in demand can be attributed to a combination of historically low interest rates which improved purchasing power; significant wealth creation as a result of the K shaped economy; the attractiveness of small towns associated with health and safety around Covid concerns; and increased awareness of both the effectiveness and flexibility of remote working.

These factors led to a strong real estate market not just in Whistler and the Sea to Sky, but in smaller communities across North America. This strong demand in Whistler, however, resulted in a significant drop in the number of properties being offered for sale and values have increased in all categories of real estate in Whistler at year end as compared to the end of 2019.

The strongest segments of the market were in the single-family market (highlighted by a record number of transactions above $4,000,000, including a sale of $19,000,000) and the family-orientated townhouse market. As such these two categories accounted for almost 65% of the value transacted for the year.

The condominium market was slightly slower than 2019 but this slight slowdown had no impact on valuations.

As of the end of December, the average transaction value for the Whistler marketplace was $1,533,451, approximately a 22% increase from 2019.

Currently the average transaction value of a single-family home is $3,445,238 (median of $2,450,000). Townhouses are averaging $1,433,905 (median of $1,240,000) and condominiums are averaging a sales value of $839,590 (median of $675,000).

YEAR END 2019

Whistler’s Real Estate market in 2019 began slowly, paralleling trends seen throughout British Columbia which began back in the second half of 2018 and continued into the first half of 2019.

However, a strong recovery in consumer confidence combined with low-interest rates and a strong tourist season saw the marketplace return to its historical levels of activity during the second half of 2019. Therefore, despite the total number of transactions being below that achieved in 2018 by 16%, the overall average transaction remained essentially unchanged from that achieved in 2018, finishing the year at $1,247,388

That being said, different categories of the market experienced different results during 2019 that should be highlighted to better understand where we stand heading into 2020.

Single-Family Homes in Whistler

Despite an approximately 12% reduction in activity, the average transaction value was largely unchanged from one year ago, finishing 2019 at $2,881,000. Over the course of the year the number of properties offered for sale increased steadily and the total number of listings, as well as the average time on the market, also increased. Going into 2020 we will see a balanced market for single-family homes, particularly those below $3,000,000.

Townhouses in Whistler

The townhouse market experienced both an 18% decline in activity, and a drop in average transaction value by 11%. By the end of 2019, the average sales value for a townhouse was $1,354,000. Much of this sectors behavior is as a result of fewer luxury townhouse sales, an increased focus on properties that offered short term rental opportunities combined with fewer listings being offered on market. Overall value per square foot held steady at $1,150.00 a square foot. The average time on the market also remains largely unchanged and the number of listings has not increased. Going into 2020 we expect this market to be balanced, with a continued strong interest in lower-priced townhouses that offer rental opportunities. We anticipate sales value to continue in the $1,100-$1,200 square foot range.

Condominiums in Whistler

Similar to the last two sectors, the condominium market experienced a drop in sales activity in 2019, 15% below 2018. However, it was the most active part of the market with over 200 sales. Strong demand for condominium properties fuelled an increase of the transaction value by 9% to $733,000. Like the townhouse sector, properties that offered the opportunity for either managed, or personally managed, rental incomes were extremely popular and often resulted in multiple offers in the second part of the year. Overall the total number of listings fell slightly, while average days on the market increased to 43 days, but still indicative of a seller’s market.

Whistler’s Luxury Market

The luxury market in Whistler (properties over $3,000.000) is a highly specialized, unique market that is difficult to analyze. This is due to its small size and the unique features that are often found with these one-of-a-kind properties. Overall, sales activity fell significantly during 2019, however, the average value of those transactions increased by 7% during the year to finish at $4,856,368 ($1,483 per square foot). As we move into 2020, the expected time on the market will begin to lengthen as a result of the slowly increasing number of properties being offered for sale in this price range when compared to prior years. We would expect that sellers should be patient, and price effectively if they wish to meet their goals within the next 12 months. The luxury market going into 2020 can best be described as a buyer’s market.

The third quarter of 2019 saw increased sales activity after a slower than average second quarter, bringing activity levels back to that of the last 6 quarters. The current market has stabilized from the frenzied conditions of 2015-2017, although overall sales values remain strong and relatively consistent.

Overall average transaction value YTD is $1,269,800 – a slight increase on values from the first quarter. Buyer demand remains strong with continued interest in the resort and high visitation levels.

YEAR END 2018

After heightened and frenzied activity throughout 2015-2017, the Whistler real estate market has now entered a period of stabilization, with a cooling of market activity. Over the course of 2018, the volume of transactions dropped by 26% YOY and are at consistent levels seen prior to the peak of the Whistler market cycle in 2015-2017; the pace at which activity dropped was accelerated in the 3rd and 4th quarters by a rise in interest rates and new mortgage approval rules began to dampen buyer enthusiasm locally, regionally and nationally.

The total value of transactions reported to the Whistler Listing System for 2018 was approximately $828 million, down 18.2% YOY. However, despite a slowing in transactional activity, the average property value in Whistler has continued to increase to $1,250,168 – an increase of 7.5% from 2017.

Single Family Homes and Large Townhomes: Family oriented accommodation continued to attract strong interest; however, the scarcity of opportunities and higher average price points mitigated the amount of demand. As such, average values for single-family home transactions in 2018 only appreciated by approximately 2.5%.

Condominiums and Townhomes (with nightly rentals): Increased international awareness as a result of the Vail purchase as well as the success of the community in significantly increasing overnight guests to the resort created strong interest from both traditional real estate investors and leisure-buyers looking to offset their personal usage with rental income. Overall, the average transaction value for condominiums in Whistler increased by just over 11% to $664, 390 while the average townhouse transaction value increased by 33% to $1, 526,168 in 2018. Accounting for 67% of market activity and 56% of the total market value, the condominium and townhouse sectors represent the majority of the transactions in the Whistler real estate marketplace.

Luxury Market (properties in excess of $2 million): This continues to be a strong part of the Whistler market and, with 119 total transactions, activity remained very consistent as compared to 2017. Overall these sales represent 18% of all transactions and approximately 48% of the total transaction value. The average transaction value for this segment was $3,363,000, down slightly from the previous year.

Many properties in Whistler are now valued and selling in excess of $1,000 a square foot, which places our real estate market on par with most of the elite ski resorts in North America – the Canadian below par dollar offers good value to international buyers compared to their domestic markets.

Going into 2019, we expect the Whistler real estate market to operate under more balanced conditions, with limited appreciation in price levels with the exception of some niche offerings experiencing pent up demand and limited historic inventory. As popularity in Whistler as a resort continues to grow, we expect to observe a continued supply of demand and buyers looking to benefit from their investments. As such, supply and demand will direct pricing in the year ahead.

We are dedicated to keeping abreast of our market to ensure we provide you with a well-informed, and current strategic view of investment potential and advice on your purchase or sale. If you have questions, or would just like to chat about the current market, please email us or call 604-932-7670 any time.

YEAR END 2017

The Whistler real estate market experienced another active year in 2017, resulting in significant price increases in most sectors and over one billion dollars of transactions. Despite the total reported sales falling below 2016, strong buyer interest continued to drive valuations.

Total transactions decreased by 16.2% compared to 2016, however this was more than offset by a 26% increase in the average transaction price (currently $1,163,392 compared to $901,451 at the end of 2016). The first half of 2017 was particularly strong due to a peak in buyer interest however as the number of properties offered for sale continued to decline market activity slowed.

YEAR END 2016

2016 marked one of the most active years on record with over $1 billion worth of sales driven by significant price appreciation across all major segments; overall transaction volume increased YOY by 22% and YOY value by 12.6% to $901,765.

Chalets & Townhomes: Buyer interest was particularly strong in the first two quarters, resulting from continued favourable exchange rates, low interest rates and record breaking resort visitation. Large family orientated properties (single family and townhomes) observed the highest rates of appreciation with YOY values for single family homes increasing by 32% to $2,252,000 and townhomes increasing by 24% to $947,000.

Condos: The highest level of transactions was seen in the condo market, with over 400 transactions reported year-end and a marked 11.7% YOY increase in volume.

Condominiums and townhomes currently represent 65% of the total market leading to almost 70% of all transactions in 2016 were under $1,000,000.

We anticipate a decline in transaction activity across all segments as listing inventory approaches a historic low, despite strong buyer interest resulting in continued upward pressure on property values. However, external market factors remain unpredictable in their influence of our market, including interest rates, government and financial regulation and the impact of a Trump presidency in the US.

YEAR END 2015

The Whistler real estate market has seen continued growth for the past 5 consecutive years in both sales activity and sales value; the most recent data indicates market conditions have returned to those prior to the financial collapse in 2008/2009.

The resort’s continued efforts in positioning Whistler as a diverse, year-round destination has resulted in ongoing growth in Whistler real estate demand; low interest rates, a favourable Canadian dollar, and an active real estate market in the Greater Vancouver area are all contributing factors to the upward pressure on prices across all market segments.

Overall, sales volume increased YOY by 14% and total sales value exceeded $673 million. Average sales transaction value was the highest seen since 2007, reaching $799,937 at the end of 2015 – a YOY increase of 10.5%.

LUXURY MARKET

The luxury real estate market ($2 million+) continues to strengthen with a 33% YOY increase in sales volume and a 55% YOY increase in total sales value.

Of the sixty luxury market transactions in 2015, our team represented 33 clients – accounting for nearly half of total sales value for this market ($139m+).

CONDOS & TOWNHOMES

Condo and townhomes had a 6% increase in transaction volumes and an average year-end sales price of $415,600 (YOY increase of 7.1%) and $756,142 (YOY increase of 8.4%) respectively.

SINGLE FAMILY HOMES

Activity in the single-family home market increased by about 22% with an average transaction value of $1,697,000 – a YOY increase of 5%.

Inventory remains low in Whistler (the lowest in over a decade) – resulting in well-priced listings selling quickly, often under multiple offer situations. As we enter 2016 prices are expected to remain strong as contributing market factors are likely to remain unchanged. Sales activity is expected to slow after our record year in 2015 due to an absence of new developments and new opportunities in the market place.